Aldermore, the brand new pro financial for borrowers having all the way down credit ratings, has cut costs because of the up to 0.7 payment items round the their highest LTV diversity both for the fresh and you may current residential consumers. The financial institution offers a-two-seasons Premier fixed rate for BTL pick in the cuatro.29% which have a good £1,999 fee (60% LTV), or an identical four-seasons offer during the 4.24%. Chosen get-to-let (BTL) fixed rates for new and current individuals can also be reduced by as much as 0.step 1 fee part.

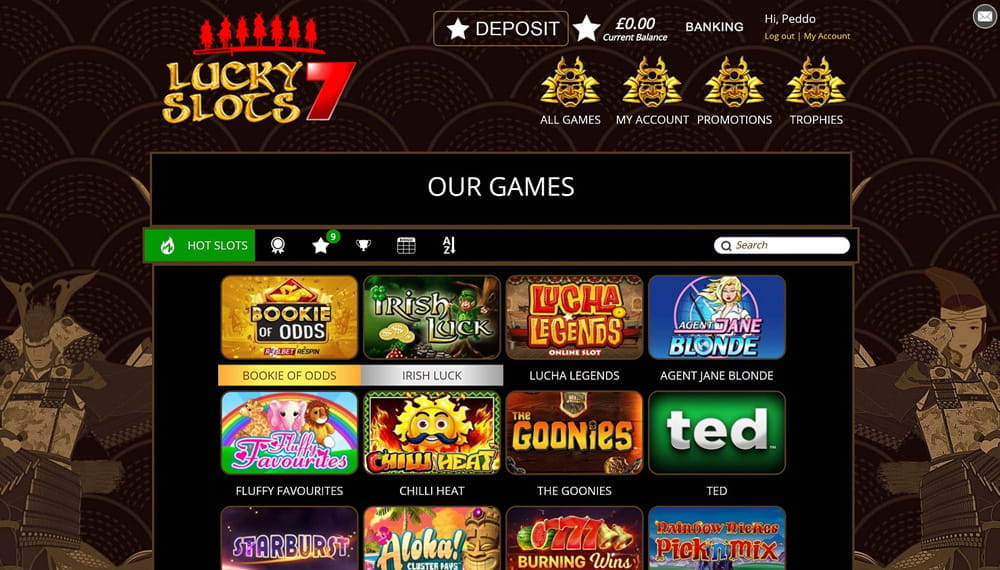

Small print With no Deposit Bonus Casino Rules

As you will discover cost higher than which for starters-season terminology, these are often offered just to those people locking aside a large amount of money, including $250,000 as well as. Regardless of, just like any economic decision, you can find several things you will want to believe before spending their hard-attained fund. Which range from how long you’re also able to shop your bank account away for, just how much your’re also happy to invest and exactly what come back you’lso are hoping to discovered. And, you need to believe if getting your money out for an excellent timeframe are viable. For some Australians, 12 months may be the restrict, while some are happy in order to lock fund aside for five decades or higher. It’s your own decision, that’s the reason here’s nobody-size-fits-all of the for the “best option” away from name put.

The mortgage Functions, the new pro lender owned by Across the country strengthening neighborhood, has slashed chose two- and five-seasons fixed speed sale for buy-to-let individuals by the up to 0.twenty five percentage issues, energetic from 17 April. It’s offering a-two-seasons package to possess BTL buy or remortgage from the step 3.14% that have an excellent step three% percentage (65% LTV). The lending company also offers released a selection of £750 cashback sales to possess restricted team landlords looking to remortgage.

Pulsz Gambling enterprise – Get Free SCs to have $4.99

Interviews was submitted, transcribed verbatim, coded and you will examined having fun with thematic analysis. Around three coders on their own analyzed transcripts and you may satisfied frequently to refine codes and you may resolve inaccuracies, making certain rigor and sincerity. Drinking water beads are awesome‐absorptive polymers (SAPs) which can be widely used as the sensory toys. He has as well as lead to a huge number of disaster agency visits due to their accidental consumption by college students. Unintentional intake can result in choking, however, far more serious difficulty including bowel congestion, and also demise.

- HSBC now has a-two-12 months repaired rate to have home purchase at the cuatro.12% which have a great £999 commission.

- Pala Gambling establishment does not require a minimum deposit for many who include financing through the Cash-at-Cage option.

- The internal band and you may case, motivated from the Alexis retractor, is registered through the stoma and you will to your lumen of the colon.

- The analysis is designed to gauge the aftereffect of weaning dupilumab dose for the clinical and you can histologic remission in kids having EoE.

- Basic Head, that is an internet and mobile phone financial belonging to HSBC, simply lends right to consumers and you may doesn’t focus on brokers.

- The research were presented before the utilization of gastrostomy to possess giving.

To be considered, you’ll have in all probability to set up head deposit to your lender and keep the new account discover for around a few months. In the Oct 2025, savings account bonus also provides you may property you anywhere between $one hundred and you will $step 3,100. Lender promotions otherwise bank bonuses spend you to definitely unlock a new checking account and are readily available for checking account and frequently to own deals. You could have seen this type of indication-upwards incentives and you will the fresh consumer now offers stated a lot of minutes.

TSB features reduced repaired rates across the their range by around 0.dos percentage things. Among its the fresh selling is a charge-100 percent free two-year repaired price for family buy at the cuatro.84% for individuals with an excellent ten% cash put (90% LTV), and therefore pays £500 cashback to your achievement. MPowered Mortgages has made its 4th cut to fixed cost since the the start of April, cutting about three-12 months fixed price selling for new consumers.

Returns for the Langley Federal Borrowing Relationship Certification of Deposits are combined and credited for you personally month-to-month. To possess profile you to automatically replace, you have a good seven-day sophistication several happy-gambler.com use a weblink months immediately after readiness so you can withdraw money instead of penalty. Very early penalty charge is actually 90 days’ dividends to possess terms of less than 12 months and you will 180 days’ dividends to own regards to one year otherwise lengthened. We like one Credit Individual Display Certificates offers a solid lineup of Cd account, all of the that have fairly aggressive costs. These types of brief Cds echo exactly what typical everyone is carrying out using their savings. In the event the Fed gutted their funds arrives offers within the 2008, they forgotten interest in Cds plus the cash reverted in order to deals and you will checking profile, or ran elsewhere.

Big Investigation China

We love the around three-week Computer game offers the highest produce out of DCU Normal Cds—3.75% APY—and contains a relatively lower harmony demands. Very early detachment charges confidence your own Cd term and just how much you withdraw. To have accounts you to definitely instantly renew, you have got a ten-date grace months just after readiness to help you withdraw otherwise put financing instead penalty.

High-society Slot Remark Summary

April Mortgages has increased their financing money several to seven minutes money to have borrowers with the absolute minimum earnings (solitary individual otherwise home income) out of £50,000 bringing a ten otherwise 15-12 months repaired price package. Nationwide building neighborhood is reducing the expense of a range of their repaired-price product sales and you will tracker prices from the as much as 0.step 3 fee issues, produces Jo Thornhill. April Mortgages and you will Gable Mortgages has each other introduced a lot of time-term fixed costs geared towards consumers who want so you can obtain the new full value of their family, also known as a 100% mortgage to help you value (LTV) mortgage. Other lenders, and Skipton strengthening neighborhood, Darlington building community and you may Accord Mortgage loans, section of Yorkshire building area, have reduced the expense of selected repaired-speed selling. Certainly its remortgage sale, Across the country provides a-two-seasons repaired speed at the 3.99% with a £999 payment to own home owners that have at least 25% guarantee within property (75% LTV).

The mortgage Work, the brand new pick-to-let financial owned by Nationwide strengthening people, features reduce selected repaired rate product sales to have landlords because of the around 0.step three percentage issues, effective out of 15 February. It offers a-two-season fixed rates offer for purchase otherwise remortgage from the step three.24% that have a good step three% percentage to have individuals thirty-five% collateral or maybe more in their BTL assets. Virgin Money, owned by Across the country strengthening neighborhood, have cut a variety of residential and get-to-assist sale, offered thanks to brokers, for new and you can current people, and its shared possession the new build points. It is providing a four-year repaired speed for purchase to have individuals which have a good 20% deposit (80% LTV) during the cuatro.31% and it has a product or service transfer offer (to own current consumers trying to find a new offer) in the 4.04% (65% LTV) having a £1,995 commission.

Getting one players meet up with the conditions and terms, real cash might be acquired as much as the significance stipulated by the brand new ‘maximum cashout’ clause. The capacity to withdraw their winnings is really what differentiates no-deposit incentives of playing games within the demonstration mode. You’ll receive a money-property value incentive credit (for example £/$/€10) that you will be able to bet on multiple online game, in addition to harbors, desk game, keno and you will abrasion notes. While the incidence away from pediatric IBD will continue to go up, pinpointing resilience items that may decrease physical and mental influences away from this disease is essential.

Betting standards are a common identity and you will condition linked to no put bonuses. Referred to as ‘playthrough’, which name and you can position demands one to enjoy from worth of the added bonus lots of moments before you can withdraw their winnings. Such as, if you have a great $10 bonus which have a wagering demands put during the 20x, you have to bet an amount-total from $two hundred with your bonus ($ten x 20). Our bodies ensures all of the incentive render noted on NoDepositKings try latest and you will valid and you may removed in case it is perhaps not.

The aim should be to highlight banks anyone across the country is also have fun with, however, we don’t showcase membership one impose higher equilibrium minimums so you can both unlock otherwise manage a free account. Minimum deposit requirements out of $10,000 or maybe more affected ratings negatively, because the performed higher minimal equilibrium requirements to stop charges. It’s much easier to conserve with a goal in mind—for example a kitchen area remodel—than saving for the sake of preserving. Compared to that avoid, you could potentially unlock a number of high-yield deals accounts, for each and every using its very own goal. The brand new nearer you’re able to appointment the savings purpose inside the for every account, the much more likely your’ll be to store supposed.