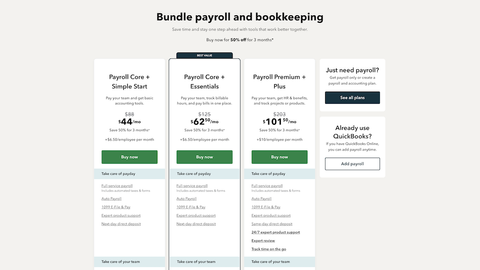

Once the free trial ends, you possibly can choose from one of three payroll plans. We recognize that QuickBooks provides clear pricing — some competitors are less open about what their plans cost. QuickBooks Payroll is comparatively straightforward to make use of — particularly when you have experience running payroll or utilizing different QuickBooks programs.

Dealing with usually annoying issues similar to payroll is nowhere close to as complicated as it used to be, however Intuit makes the job even easier. Count On a lot of automated tasks, plenty of one-click solutions and a wholesome supply of sensible benefits similar to the flexibility to hold out highly effective reporting with out become broken within the course of. Before, there have been Core and Easy Begin plans – now, the 2 have merged into Payroll Core + Simple Begin. This plan comes with full-service payroll, 1099 E-File and Pay, next-day direct deposit and lots more.

Customer Support – 4/5

Enter some fundamental information about your small business’s payroll necessities and we’ll send you up to 5 personalised quotes. With the Elite plan, although, you additionally get what QuickBooks calls tax penalty protection. With this enhanced safety stage, QuickBooks Payroll will cover as much as $25,000 of IRS fees when you incurred those fees while using QuickBooks Payroll software. Fortunately, that $6.50 per person month-to-month fee is the same across all packages.

Where Can You Find The Best Payroll Software?

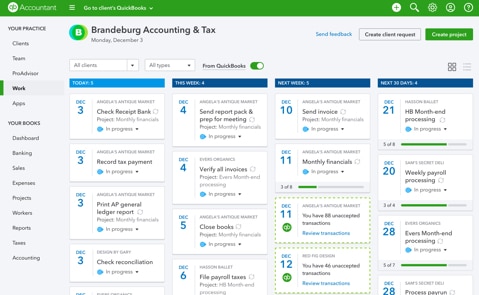

The dashboard exhibits several graphs with overviews of your gross sales over time, revenue, bills and profit-and-loss data. We’ve scoured the net to bring you real, constructive critiques from QuickBooks users on those trusted platforms. Transferring as much as the Necessities Plan, you’ll pay $30 per thirty days for the first three months, then $60 per month. This plan adds up to three users to the account in order that the right people have access to information at their fingertips. It additionally offers you invoice management and collects employee time for invoices to add them for proper billing. QuickBooks Online has 4 pricing tiers and presents 50% off for the primary three months if you buy.

Common Score Of All Product Options, Some Of Which May Not Be Shown Below

As A Substitute of manually exporting and importing data https://www.intuit-payroll.org/ between QuickBooks and your other enterprise applications, you can mechanically sync data between systems. QuickBooks integrates with top POS techniques, in style on-line shops, one of the best CRM software, project administration options, payroll systems and more. What’s extra, we discovered that QuickBooks far outpaces its competitors, technologically talking. Automation instruments, for instance, eliminate the tedious work of expense and financial tracking as well as bank reconciliation.

If you go for Payroll Core, you’re on your own for implementation. Nonetheless, we appreciated the setup wizard and on-line resources — enterprise homeowners and their teams shouldn’t have any bother. If you go with the Premium plan, a QuickBooks expert will review your setup to make sure it’s right.

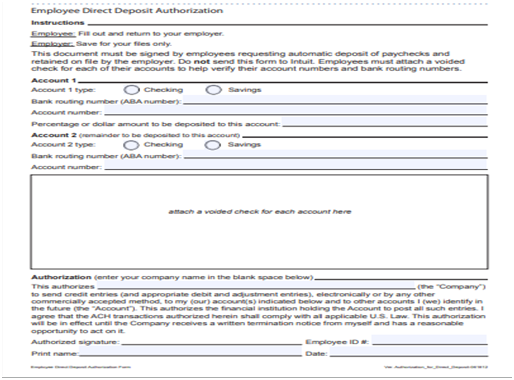

- As Quickly As you arrange your account or free trial, connecting your checking account to QuickBooks takes only some minutes.

- Payroll Core users must pay an additional $5 per thirty days for workers’ compensation administration instruments.

- There’s ease of use, plenty of worth added features plus functionality that makes gentle work of tedious chores.

- It’s really easy to see why Intuit still manages to rule the roost with so many businesses opting to make use of its suite of products.

- Once you enter personal and cost details, payroll is calculated routinely on the pre-decided date.

Like nearly all payroll distributors, QuickBooks will automatically calculate, file and pay your payroll taxes for you. It will also ship you the suitable year-end tax varieties, in addition to print and mail W-2 forms to your workers and e-file any 1099s. Some businesses wrestle to determine on a pay schedule if they’ve limited funds. We like that QuickBooks makes this easier by offering next- and same-day direct deposit, depending in your plan.

Some companies suppose it’s okay to cost extra when paired with greater tiers, so we recognize Intuit’s standardized pricing right here. Payroll Core + Necessities solely provides a couple of more features for $125 per month, whereas Payroll Premium + Plus is a much fuller package deal, but for a $203/month premium. Intuit is at all times running money-off deals throughout its entire portfolio of business-focused software, with a current 50% off for three months being fairly typical.

Most customers complain of gradual, unhelpful phone support—a big frustration when a software program problem keeps you from paying staff on time. SurePayroll is an inexpensive and easy payroll software program that provides automatic payroll runs, tax submitting, and distinctive customer service. Payroll software can save you money and time by automating tax filing, direct deposit and worker self-service.

This function lets you schedule the system to run payroll without any extra handbook work. If you have to make changes, you’ll find a way to evaluate the most recent payroll before it’s processed. QuickBooks Payroll’s features are designed to simplify the payroll process, ensure your taxes are paid, and provide health benefits in your employees. QuickBooks has an easy-to-use dashboard from the place you’ll be able to handle the payroll of your workers as nicely as unbiased contractors.